Do you feel conscious that your teeth don’t look as pearly as before due to staining? You...

Month: May 2022

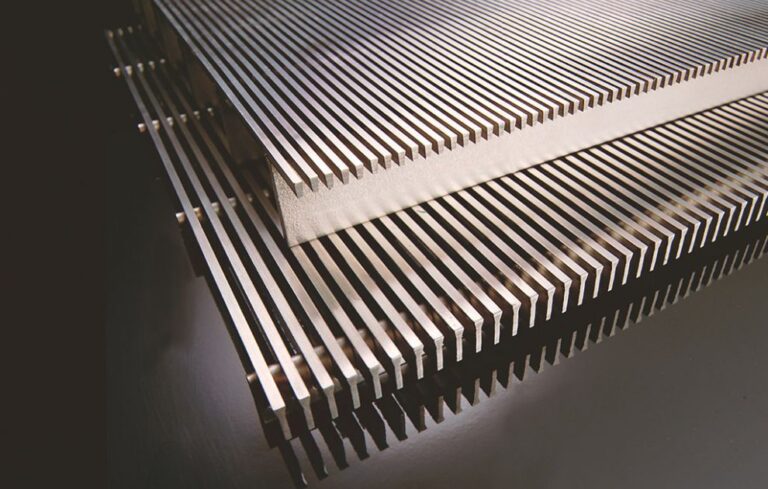

There are various sophisticated industrial processes and applications. What do you do when you have a highly...

You’re ready for the next step in your career, but it’s been a long time since you’ve...

Do you understand a lot about sports and want to invest in sports betting and apply your...

In the human body, the number of cells and tissues present can be overwhelming to remember. However,...

As a business owner, you must be going through a rough time dealing with tax issues. Also,...

The definition of the term “e-mandate” refers to the electronic version of mandates that companies utilize to...

Platforms for trading cryptocurrencies, often known as crypto-trading platforms, are online marketplaces that enable users to trade...

Every employee wants to receive retirement benefits from his employer so that they can live happily after...

Every year, when it is time to file taxes, we all tend to search for the best...